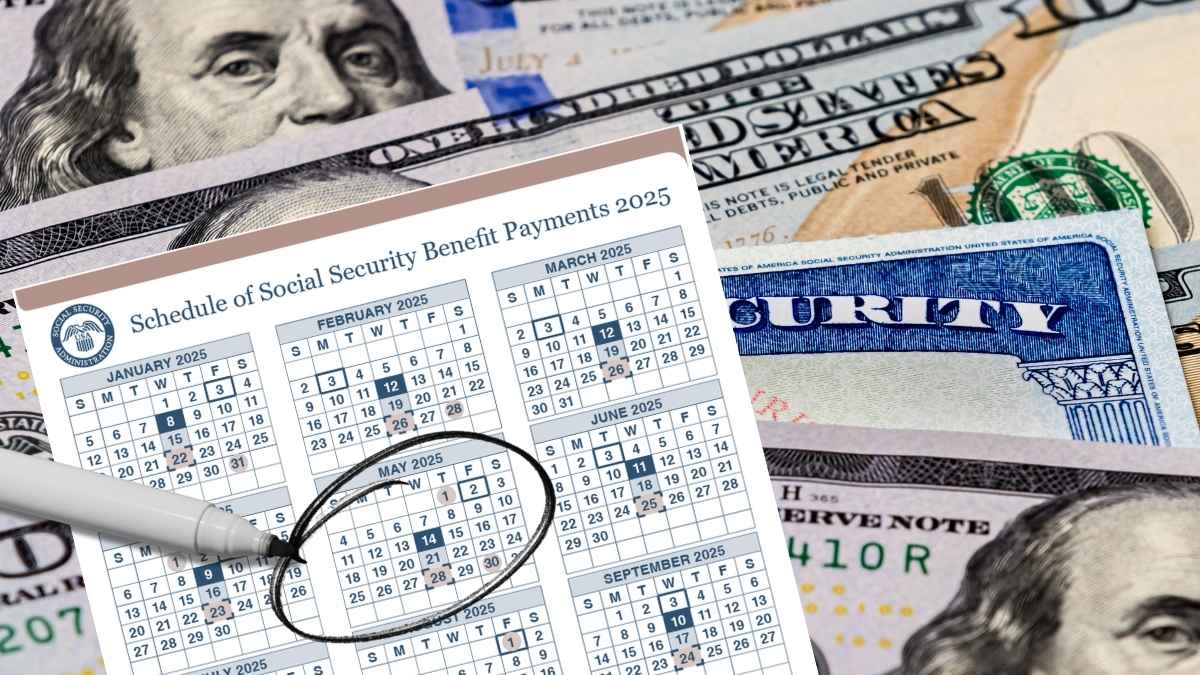

The Social Security Administration (SSA) set benefit distribution dates for retirees and disability (SSDI) recipients in May 2025. Payments will be made on Wednesdays the 14th, 21st, and 28th of the month, depending on the recipients’ date of birth. This scheme follows the official calendar published by the entity.

Recipients with birthdates between the 1st and the 10th will receive their funds on May 14. Those born from the 11th to the 20th will receive their payment on May 21, and those with birthdays from the 21st to the 31st will receive their payment on May 28. The system prioritizes Wednesdays from the second to the fourth week.

Why did the SSA wait so long in the month of May to pay benefits?

The SSA uses a model that is already proven to work perfectly: it is based on consecutive Wednesdays to expedite the delivery of funds. This method avoids congestion in the system and allows for clear financial planning for beneficiaries. SSI payments, on the other hand, are processed on the first business day of each month, according to the institution’s parallel calendar.

There are also payments on the third day of each month: in May, the 3rd fell on a Saturday, so the SSA moved it up to the 2nd (Friday). This particular group is for beneficiaries who received their payments since before May 1997, or who receive both SSI and Social Security. It also applies to those beneficiaries who reside abroad.

Maximum Social Security and Disability (SSDI) Payments

In 2025, the maximum Social Security retirement benefit will be $5,108 per month, but only for those who delay their retirement until age 70. To receive this amount, you need a history of high income, close to or equal to the annual tax limit, which in 2025 will be $176,100. Only those who have consistently exceeded that income limit can access the maximum amount of benefits.

To qualify for $5,108 per month, workers must have contributed with income equal to or greater than the taxable limit for at least 35 years. The SSA calculates the benefit using an average of the 35 years with the highest incomes, adjusted for inflation using the Consumer Price Index (CPI).

The amount varies depending on the retirement age. For example, those who retire at age 62 will receive a maximum of $2,831 per month, while those who wait until age 70 will be able to obtain up to $5,108, thus equaling the maximum retirement limit.

Those who choose to retire at age 62 will receive up to $2,831 per month in 2025, 44.5% less than the maximum possible. In contrast, delaying retirement until age 70 increases the benefit by 80% compared to full age, thanks to the accumulated postponement credits.

In 2025, the maximum Social Security Disability (SSDI) benefit amount will be $4,018 per month for those who retire at their full retirement age. This represents an increase compared to $3,822 per month in 2024.

The minimum SSI amount is set at $967 per month for 2025, while for those who have a dependent spouse, the maximum payment amounts to $1,450.