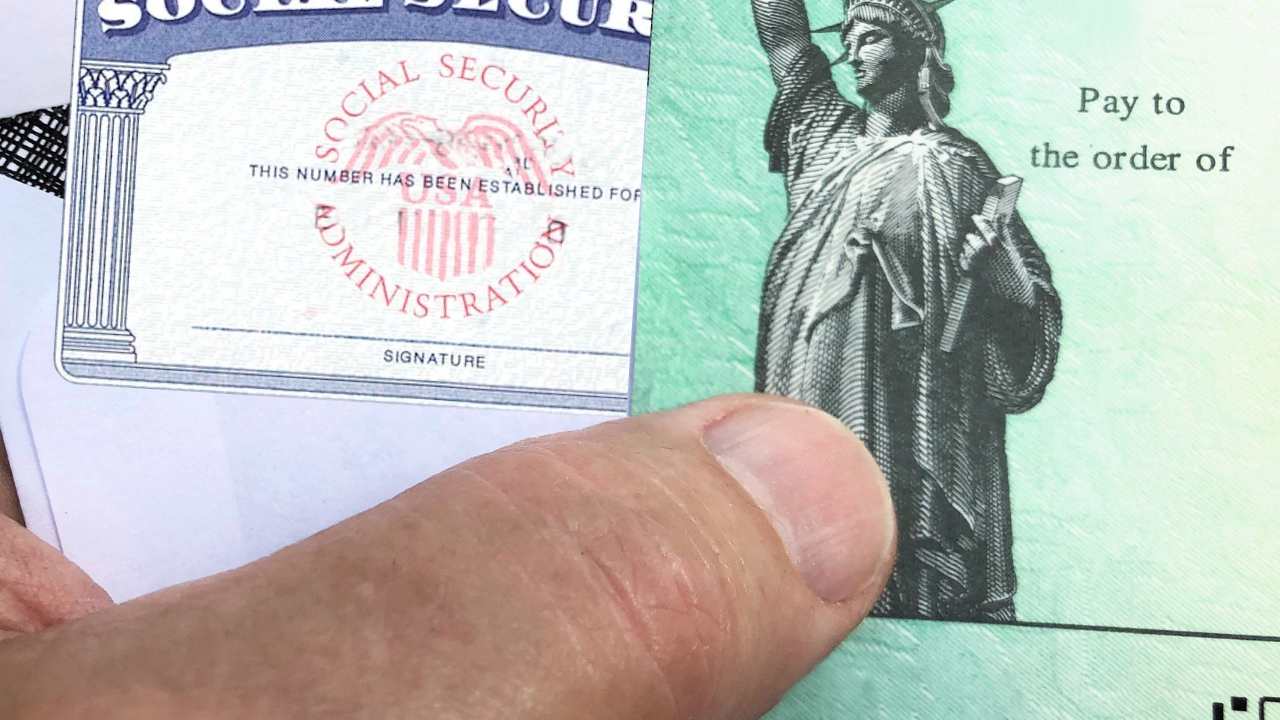

That familiar rustle of the mailbox flap, the tangible weight of the government envelope – for roughly 500,000 Americans, this monthly ritual means survival. Mostly retired seniors, folks in isolated rural areas, individuals without bank accounts, or those simply disconnected from the digital rush.

But mark your calendars: September 30, 2025. That’s the day the Federal Government officially pulls the plug on paper checks for federal Supplemental Security Income (SSI) and other Social Security benefits. Poof. Gone.

The SSI benefits checks to disappear forever

Forget thinking this is just about the SSI benefits. Think bigger. Much bigger. This seismic shift, mandated by a March 2025 executive order, sweeps up SSDI (Disability Insurance), federal retirement checks, crucial subsidies, your tax refunds, literally any dollar sent out by the Department of the Treasury.

Come October 1, 2025, your money arrives one way only: zapped electronically. Think direct deposit, the Direct Express prepaid card, or maybe an approved digital wallet. No more paper trails.

Why is the Federal Government phasing out paper checks?

Buckle up, the reasons hit hard. First up: cold, hard cash. The price tag for printing and mailing those checks last year? A jaw-dropping $650 million. Let that sink in. Now, consider this: processing a check costs around $1, but firing off an electronic deposit? Mere pennies, around $0.10 USD. Officials claim ditching paper promises savings “nearing $1 billion over ten years”. That’s money, they argue, better spent on the programs themselves.

Then there’s the ugly specter of fraud. Let’s be real, paper is vulnerable. “Printed checks are susceptible to theft, loss, or alteration“, the SSA bluntly states. The scale is staggering: “More than half a million checks vanish or get stolen annually.” Electronic payments? They’re trackable, tougher to hijack, offering a safer harbor for beneficiaries living on the edge.

And yeah, the government craves operational modernization. Paper equals delays, headaches, bloat. Trashing it speeds things up, cuts waste. This isn’t some rogue policy; it fits snugly into the Treasury’s big-picture plan to drag all federal payments into the digital age, ticking the box on that March executive order.

Sounds efficient, right? Maybe. But for those clinging to paper, the transition screams risk. The biggest fear? Payment interruption. Full stop. “Fail to switch your method before 9/30/2025, and the SSA hits pause.” Imagine the domino effect: a critical monthly lifeline delayed for an 80-year-old relying on SSDI, a disabled veteran in a connectivity desert. That check’s timeliness isn’t a luxury; it’s food, rent, medicine.

Switching isn’t always simple, either. Fewer local SSA offices, skeleton crews, the sheer need for digital or phone savvy just to start the process – it builds walls. Hearing someone fret, “How will Grandma manage? No internet, no bank…” – that worry echoes in countless homes. It’s palpable, legitimate anxiety.

Avoiding disaster hinges on acting NOW, well before the September cliff edge:

-

Jump to Direct Deposit: Safest bet. Log into “My Social Security” (ssa.gov), plug in your bank details. Banking not your thing? The Direct Express card exists precisely for this – your federal cash lands there.

-

Pick Your Path: Go online (fastest!), ring up 1‑800‑772‑1213, or brave an in-person visit (book that SSA appointment yesterday!).

-

Plea for Exceptions: Truly stuck? No access? Debilitating disability? Call 855‑290‑1545, ask Treasury about temporary exceptions. Don’t assume you qualify; gather proof like your life depends on it (because maybe it does).

-

Lock It Down: Already electronic? Turn on bank alerts. Try USPS Informed Delivery to track mail digitally. Layer up your security.