New York State is preparing to send inflation-related refund checks to millions of residents, a concrete measure to alleviate the economic pressure on households. Starting in October, as autumn begins to give us its first cold snap, those eligible will receive up to $400 without additional paperwork, marking an effort to return resources to taxpayers affected by rising prices.

With inflation impacting household budgets, New York is moving forward with its plan to distribute direct refunds to qualifying taxpayers: more than 8 million households are eligible to benefit from this plan, which is already generating conversation among New Yorkers.

Inflation refunds will be issued to 8.2 million households this fall.

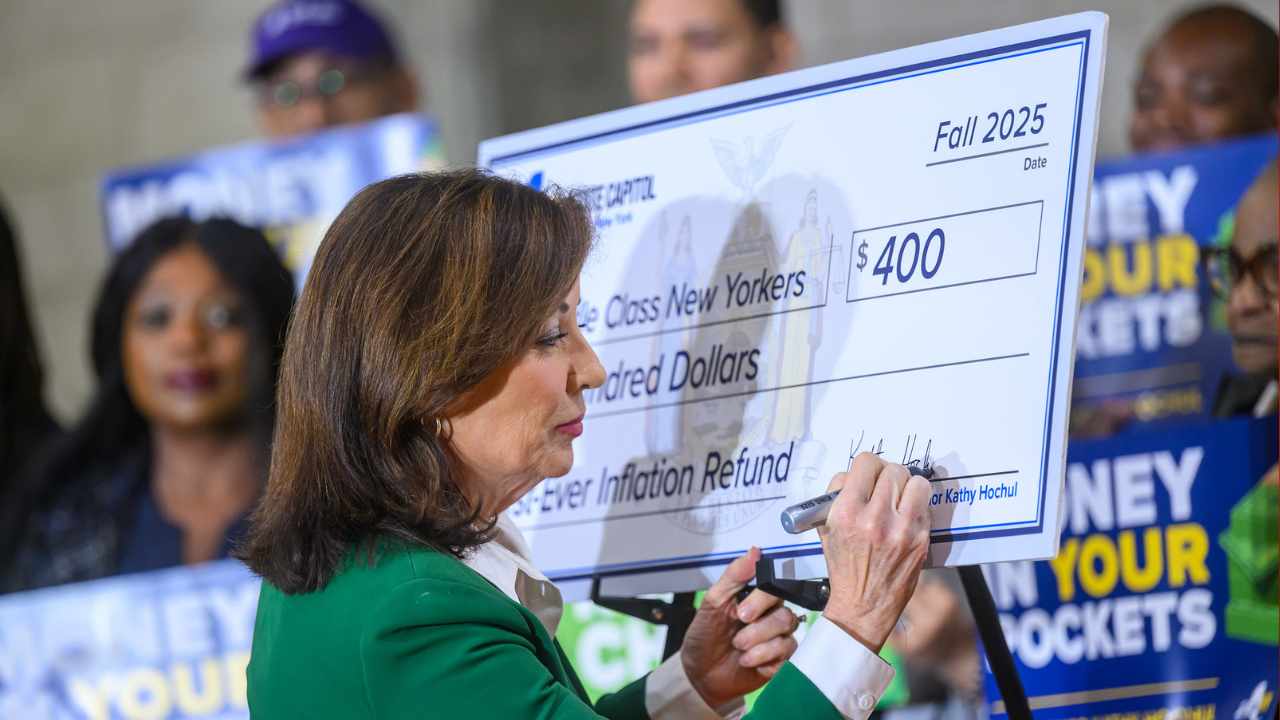

Governor Kathy Hochul announced the distribution of inflation rebate checks this fall. Payments of up to $400 will reach approximately 8.2 million households across the state. The first shipments will be mailed during October and November 2025. No paperwork is required to receive them.

This measure is part of the commitment to alleviate the financial burden on residents. The program is funded through the 2025-2026 New York State budget. The payments are intended to offset the impact of sales taxes affected by inflation.

“The Governor remains committed to putting more money in the pockets of New Yorkers,” the announcement stated. Other measures include middle-class tax cuts and tax credits. Universal free school meals were also secured in the budget agreement.

Eligibility requirements for inflation tax refunds

Eligibility depends on the 2023 tax return filed. Form IT-201, Resident Income Tax Return, is required. Taxpayers must not have been claimed as a dependent on another return.

Adjusted gross income determines eligibility and the refund amount. There are specific thresholds based on filing status. Only those who meet these criteria will receive the automatic payment.

The Tax Department will use data from filed returns. Those who did not file the IT-201 for 2023 are not eligible. The address associated with that return will be used for mailing.

These are the different amounts to be sent:

The amount of the refund check varies depending on inflation. Singles and heads of household with incomes up to $75,000 will receive $200. If your income exceeds $75,000 but not $150,000, the amount will be $150. Married people filing jointly have different thresholds.

Married couples with joint incomes of $150,000 or less will receive $400. If their income is between $150,001 and $300,000, the payment will be $300. Qualifying surviving spouses follow the same scale as married filing jointly.

Married filers filing separately use the single-file scale ($200 or $150). The amounts are non-refundable one-time payments. They do not affect future state or federal tax refunds.

The mass mailing of checks will begin in October 2025, and due to the extremely high number of beneficiaries, nearly 8.2 million, distribution could extend into November or even December.