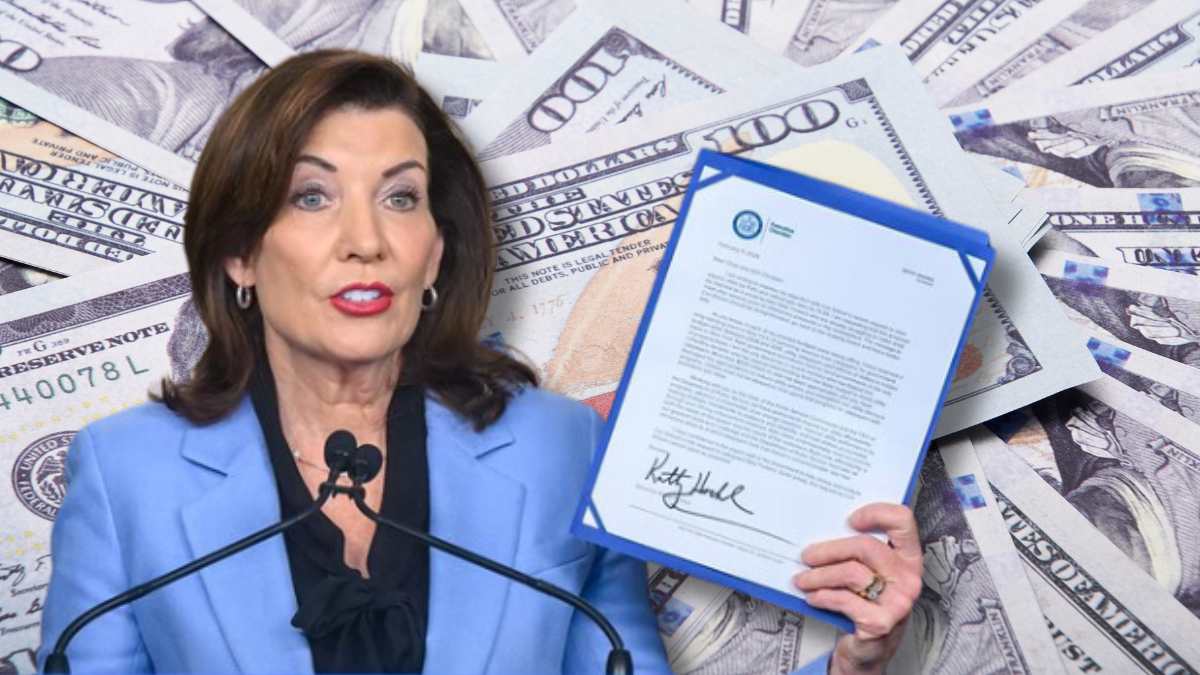

During the pandemic, inflation in the United States was certainly high. Between 2020 and 2025, there were numbers that were as high as 8% in 2022 (peaking at 9.1% in June of that year), but we also saw numbers like 4.7% in 2021 and 4.8% in 2023. That’s why New York State has launched an ambitious inflation relief stimulus check plan, the “first of its kind,” state officials say.

This stimulus payment program would benefit more than eight million residents, according to official estimates. The amounts vary depending on income and marital status, with a maximum of $400 for joint returns under $150,000 annually.

The ambitious stimulus check plan: who qualifies and who does not

Kathy Hochul’s government detailed that single taxpayers with income up to $75,000 will receive 200, while those earning between $75,000 and $150,000 will get $150. Joint returns with income between $150,000 and $300,000 will qualify for $300.

The plan excludes households with incomes greater than $300,000 (joint) or $150,000 (individual). The measure seeks to alleviate living costs in a state where, according to Marist’s April survey, 46% disapprove of Hochul’s management. Critics point out political opportunism in the face of possible internal challenges in the Democratic Party.

Jamaal Bowman and Ritchie Torres, Democratic figures, could compete for the gubernatorial nomination. 40% of Democrats reject Hochul’s re-election, according to the same survey. 59% of voters prefer other candidates, reflecting dissatisfaction with public services and quality of life.

Another plan offers from $500 to $1,000 in New York

In 2023, Hochul proposed rebates of $500, later reduced. Now, the focus is one-time payments without recurrence. At the same time, Georgia is moving forward with its own refund plan, promoted by Republican Governor Brian Kemp. Both programs emerge in an election year, fueling debates about partisan motivations.

New York officials have not clarified whether the payments will require additional legislative approval or how they will be funded. There are also no details on distribution mechanisms (checks or deposits).

Returning to the current year, Hochul also celebrated the passage of the fiscal year 2026 budget, which will return $5,000 to New York families. This budget will triple New York’s Child Tax Credit, reduce taxes for middle-class residents, send inflation-based rebate checks directly to millions of households, and guarantee free school meals for more than 2.7 million students statewide.

“The cost of living is still very high, so I promised to give them more money, and we did,” said Governor Hochul. “Refunding nearly $5,000 to families means helping New Yorkers cope with the rising cost of food, raise children, and simply enjoy life. When I said your family is my fight, I mean it, and I will never stop fighting for you.”

Under this plan, families will get $1,000 annually for each child under 4 years old and $500 for children between 4 and 16 years old. This is the largest expansion ever seen in the state, reaching 2.75 million children, according to official data.

The average credit will double: from $472 to $943 dollars annually per family. But there is more: the reform eliminates bureaucratic obstacles that previously excluded middle class families. “Now, even households that previously earned too much to qualify will receive help,” explained a Hochul advisor. It is estimated that 187,000 additional children will benefit, many in households that have never received this support.

Imagine: a family with two children (one 3 years old and the other 10) that earns $110,000 will receive 1,500 annually ($1,000 more than before). Even a household earning $170,000 (which didn’t qualify before) will get an extra $500 a year.

“This isn’t just a number on a piece of paper. It’s money for diapers, school supplies or putting extra food on the table,” said Maria Gonzalez, a Queens mother. The measure comes at a key moment, when the cost of living in New York reaches historical records.

The governor highlighted that this tax reform “closes the gap between working families and inflation,” although some Republican legislators question the total cost of the program. The truth is that, for millions of New Yorkers, 2026 could bring a much-needed economic respite.

The authorities will announce in the coming weeks a digital platform to verify requirements and calculate personalized benefits.